Tax Consultant Job Responsibilities

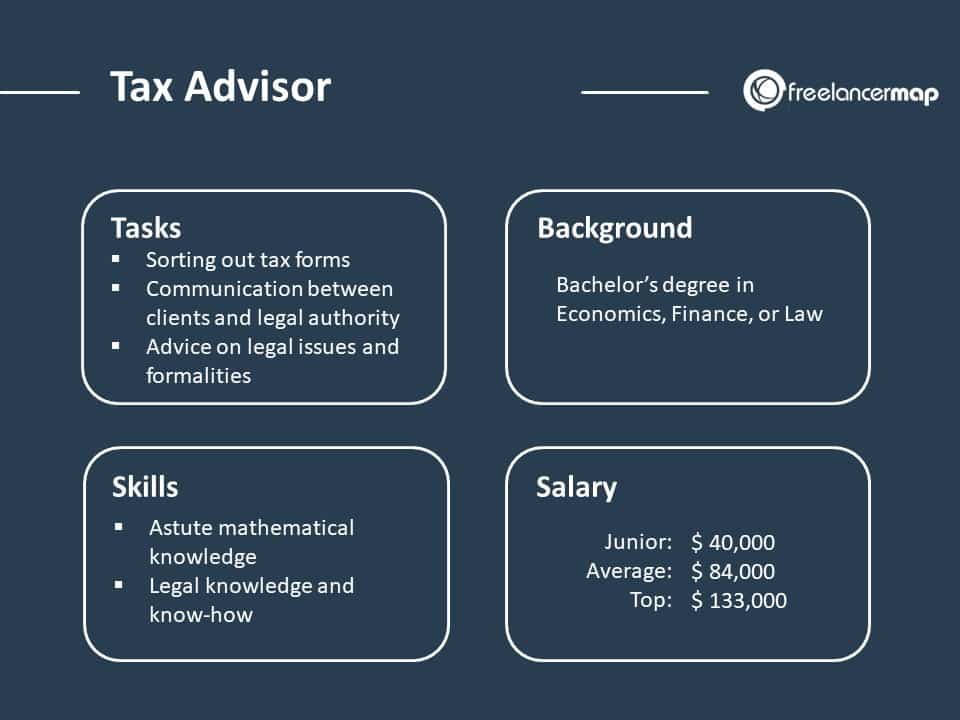

A Tax Consultant is required to calculate the taxes on a firm’s production, purchase and sales transactions. He is involved in preparing tax reports and maintaining a record of the paid tax amount and the tax amount that needs to be paid. It is essential for a candidate to have knowledge about accounts and taxation in order to get into this position.

Tax Consultant Job Responsibilities

- Tax Consultant job responsibilities include computing taxes that are to be levied on the various transactions made by a firm.

- Tax Consultants are required to maintain a record of the tax amount that has already been paid.

- Tax Consultants need to compute the amount that needs to be paid as tax.

- Tax Consultants help their clients in filing the tax return.

- Tax Consultants are required to compile the tax bills.

- Tax Consultants advise their clients on paying the tax and also help them in completing the paper work and other formalities.

- Tax Consultants may give instructions or suggestions to the tax collector.

- Tax Consultants are responsible for handling the customer’s queries related to tax payment and also resolve any kind of dispute.

- Tax Consultants are required to maintain a record of the tax payment details of different clients or their firm.

- Tax Consultants help in easing off the hassle of paying the tax amount. They make different payment plans for their customers depending upon their payment capacity.

- Tax Consultants must see to it that they compute the taxes based on the latest rates set by the government and also follow the set regulations while calculating it.

Category: Consultant Job Responsibilities