Tax Advisor Job Responsibilities

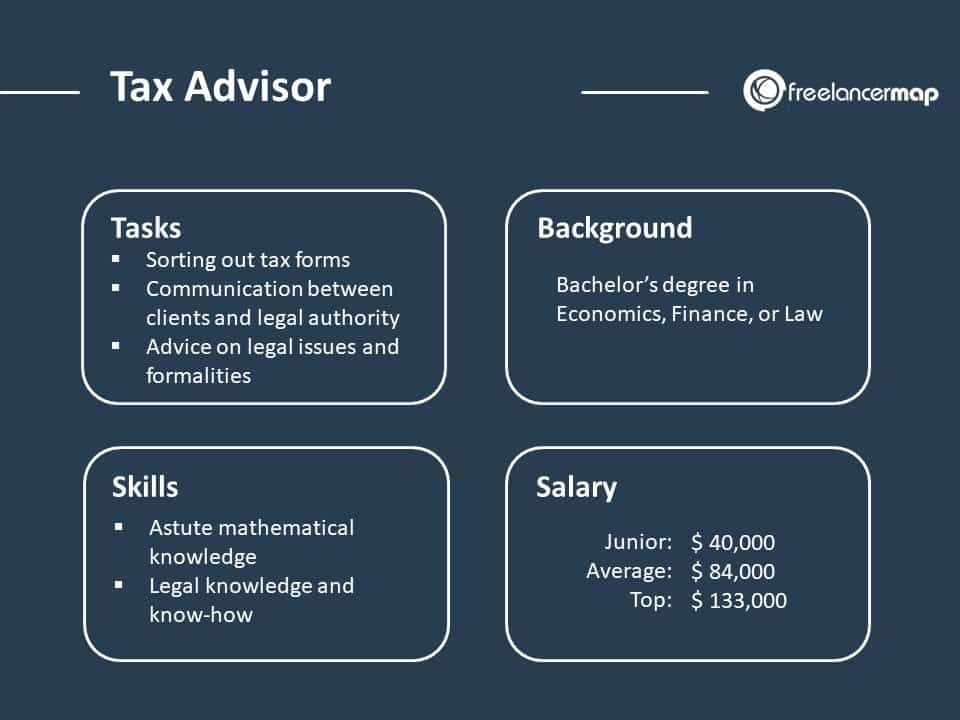

A tax advisor is the professional who is responsible for advising, making suggestions to their clients about taxes and efficient taxation techniques. They basically work as mediators, who act as a link between the government and the public and help people understand the issues related with taxation and its regulations. A tax advisor must have very good communication skills and excellent knowledge about his area of working.

Tax Advisor Job Responsibilities:

- Tax advisor job responsibilities include helping their clients with efficient taxation techniques.

- These professionals are also responsible for reviewing and studying financial transactional records of their clients and suggest them techniques to minimize the amount of tax paid by them.

- Tax advisor job responsibilities also include helping and guiding clients to fulfill all the taxation formalities and filling tax related documents.

- Tax advisor job responsibilities also include providing time to time information to the clients about tax regulations and stipulated deadlines for submitting tax.

- These candidates are also responsible for maintaining individual tax related documentation pertaining to all their clients.

- Tax advisor job responsibilities also include reviewing and analyzing the financial expenses and transactions of their clients to calculate tax amounts to be paid.

- These candidates are also required to research the effective tax reduction techniques for their clients.

- The tax advisor is also required to gather the latest schemes, techniques offered by various financial institutions to help in tax reduction for the clients.

- These professionals are also required to conduct market surveys to find out about the taxation schemes and regulations, new rules and policies in the field and latest trends.

Category: Banking Job Responsibilities